One significant factor of amortization is time. Initial monthly payments will go mostly to interest, while later ones are mostly principal. How much of that monthly payment goes to interest and how much goes to repaying the principal changes as you pay back the loan. To keep loan payments from fluctuating due to interest, institutions use loan amortization.Īmortization takes into account the total amount you'll owe when all interest has been calculated, then creates a standard monthly payment. Basically, the less principal you still owe, the smaller your interest is going to end up being. The amount of interest you pay on the borrowed money, or principal, changes as you pay back the money. When you get a loan from a bank or a private financial institution, you have to pay interest back on the money you borrow. You can also take advantage of amortization to save money and pay off your loan faster. Loan amortization doesn't just standardize your payments. Your loan may have a fixed time period and a specific interest rate, but that doesn't mean you're locked into making the same payment every month for decades. Just like with any other amortization, payment schedules can be forecasted by a calculated amortization schedule.How to Accelerate Repayment with Loan Amortization law, the value of these assets can be deducted month-to-month or year-to-year. For more information about or to do calculations involving depreciation, please visit the Depreciation Calculator.Īmortization as a way of spreading business costs in accounting generally refers to intangible assets like a patent or copyright. Although it can technically be considered amortizing, this is usually referred to as the depreciation expense of an asset amortized over its expected lifetime.

From an accounting perspective, a sudden purchase of an expensive factory during a quarterly period can skew the financials, so its value is amortized over the expected life of the factory instead. Items that are commonly amortized for the purpose of spreading costs include machinery, buildings, and equipment. Spreading CostsĬertain businesses sometimes purchase expensive items that are used for long periods of time that are classified as investments. Generally, amortization schedules only work for fixed-rate loans and not adjustable-rate mortgages, variable rate loans, or lines of credit. Also, amortization schedules generally do not consider fees.

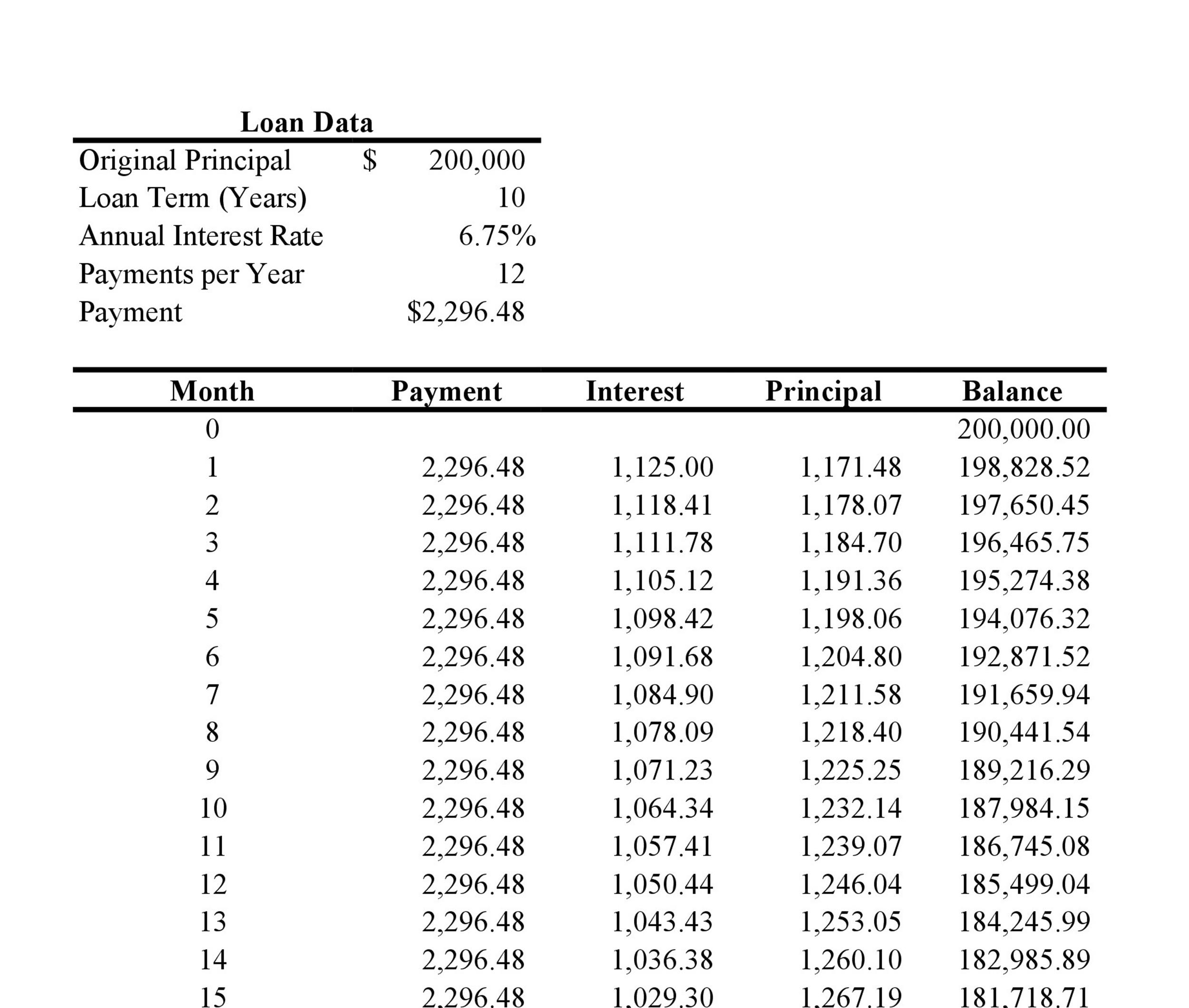

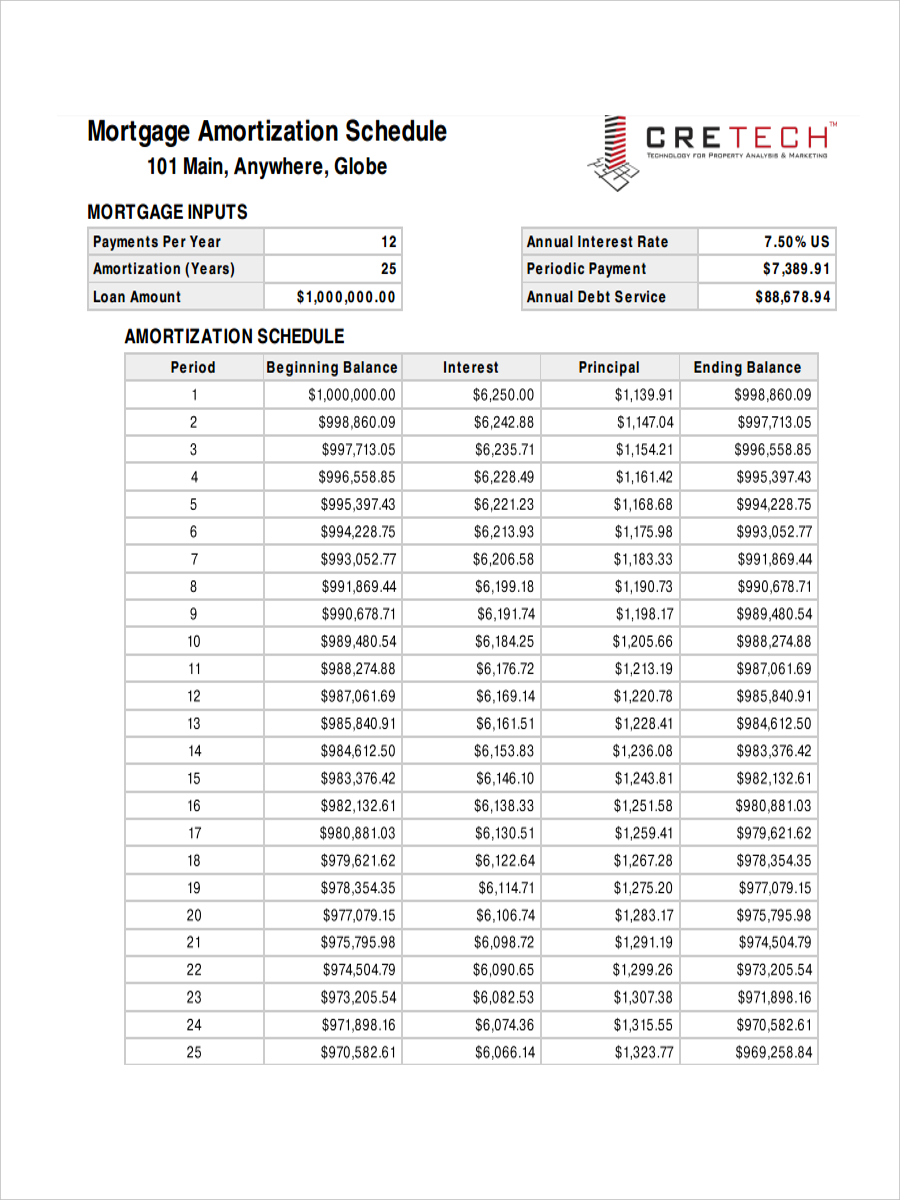

An amortization schedule helps indicate the specific amount that will be paid towards each, along with the interest and principal paid to date, and the remaining principal balance after each pay period.īasic amortization schedules do not account for extra payments, but this doesn't mean that borrowers can't pay extra towards their loans. Each repayment for an amortized loan will contain both an interest payment and payment towards the principal balance, which varies for each pay period. Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. The former includes an interest-only period of payment, and the latter has a large principal payment at loan maturity.Īn amortization schedule (sometimes called an amortization table) is a table detailing each periodic payment on an amortizing loan. Examples of other loans that aren't amortized include interest-only loans and balloon loans. Please use our Credit Card Calculator for more information or to do calculations involving credit cards, or our Credit Cards Payoff Calculator to schedule a financially feasible way to pay off multiple credit cards. They are an example of revolving debt, where the outstanding balance can be carried month-to-month, and the amount repaid each month can be varied. It is possible to see this in action on the amortization table.Ĭredit cards, on the other hand, are generally not amortized.

Interest is computed on the current amount owed and thus will become progressively smaller as the principal decreases. A part of the payment covers the interest due on the loan, and the remainder of the payment goes toward reducing the principal amount owed. When a borrower takes out a mortgage, car loan, or personal loan, they usually make monthly payments to the lender these are some of the most common uses of amortization. The two are explained in more detail in the sections below. The second is used in the context of business accounting and is the act of spreading the cost of an expensive and long-lived item over many periods. The first is the systematic repayment of a loan over time. There are two general definitions of amortization. While the Amortization Calculator can serve as a basic tool for most, if not all, amortization calculations, there are other calculators available on this website that are more specifically geared for common amortization calculations.

0 kommentar(er)

0 kommentar(er)